Updated 21 minutes ago Gilgo Beach search latest ... Tax breaks for manufacturer... Knicks playoffs ... Islanders vs. 'Canes, Game 3

LONG ISLANDERS' FAVORITES

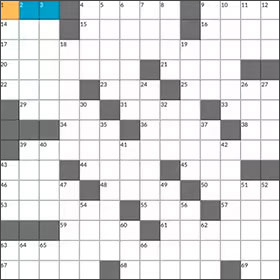

Newsday's daily crossword puzzle

Test your knowledge with Stan Newman's crossword.

Play Mahjongg Online

Play Mahjongg, everyone's favorite classic tile-matching game. Match tiles, clear the board and exercise your mind with Newsday.