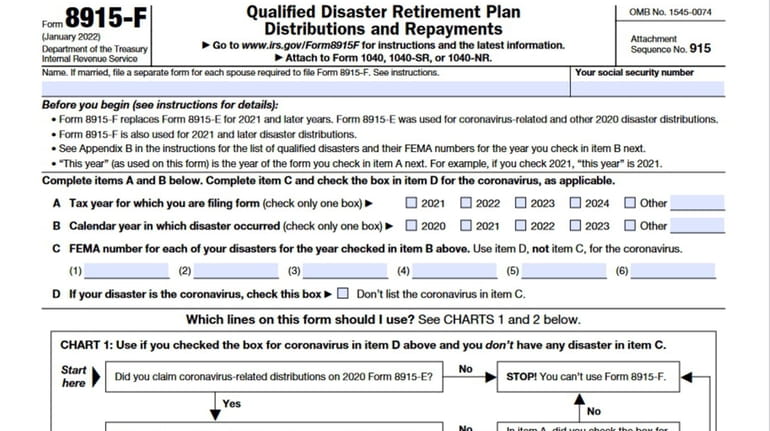

'Forever' form 8915-F issued by IRS for retirement distributions

Those who took an early retirement account distribution during the COVID-19 pandemic will need to navigate IRS form 8915-F. Credit: IRS.GOV

The IRS has issued a new "forever" form for taxpayers who took early distributions related to COVID-19 from their qualified retirement accounts in 2020.

"Form 8915-F is a forever form" and replaces 8915-A, 8915-B, 8915-C and other such forms that were used for retirement distributions in previous years, according to the agency's tax instructions.

The 8915-F form is required to file with repayments of qualified distributions taken in 2020 related to coronavirus and those related to federally designated disasters in the future, according to the IRS.

Lynne M. Fuentes, managing partner at Fuentes & Angel CPAs LLC in Jericho, noted that Washington declared the COVID-19 pandemic a nationwide disaster in 2020.

That allowed many New Yorkers and other Americans to dip into their retirement accounts in 2020 before their official retirement age and withdraw as much as $100,000 without penalty if they repay the distribution within three years.

Alternatively, retirement account holders could now hold onto the distribution money but pay the taxes over three years without an early-withdrawal penalty because of the pandemic.

Under most normal circumstances, holders of qualified retirement plans like individual retirement accounts (IRAs), 401(k)s and 403(b)s who withdraw money before age 59 1/2 (or the plan's specified retirement age) are slapped with a 10% penalty in addition to taxes, said Fuentes, president-elect of the New York State Society of CPAs.

The Internal Revenue Service (IRS) headquarters in Washington, D.C., U.S., on Friday, Feb. 25, 2022. The IRS is expanding its capacity to process tax returns following criticisms from members of Congress about taxpayers waiting months to get their refunds. Photographer: Al Drago/Bloomberg Credit: Bloomberg/Al Drago

Though the coronavirus pandemic affected the entire country, most of the other designated disasters that allow taxpayers to take an early distribution from retirement accounts without penalty occur within a specified geography.

For example, disasters qualifying for early distributions in 2017 included hurricanes Harvey, Irma and Maria and the California wildfires.

The IRS allowed early 2020 distributions to people if: they or their spouse or dependent were diagnosed with the COVID-19 virus; they experienced financial stress because they or another household member was quarantined, furloughed, laid off or had their work hours reduced; they were unable to work because child care was unavailable; they had to close or cut the hours of their business, or their pay was cut or a job offer was withdrawn.

While some taxpayers took early 2020 retirement withdrawals to shore up their finances, others used withdrawals to join Long Island's home remodeling boom during the pandemic, Fuentes said.

"Many I tried to convince not to [take the withdrawal] because of the long-term earnings loss you'll have in that [retirement] account," she said. "To rebuild that $100,000 does not happen overnight."

Although the IRS has issued 8915-F, the form is not yet incorporated into some online tax software programs, Fuentes said.

"Things like this make tax season more complicated," she said. "It definitely causes headaches."