NY to some taxpayers: Tax rebate checks will be in the mail

The state's changes in how some New Yorkers will receive their property tax rebates has created a bit of confusion for some taxpayers and local assessors who are fielding complaints that some checks are late. Credit: Newsday

ALBANY — The state’s changes in how some New Yorkers will receive their property tax rebates has created a bit of confusion for some taxpayers and local assessors who are fielding complaints about late checks.

For most families, the new tax break of about $130 for the New York City suburbs, including on Long Island, and $185 upstate is deducted upfront from local school property tax bills under the new version — included in the 2014-2015 state budget. Individual tax exemptions, however, can vary widely by community based on taxes and property values. The tax break is a new version of the popular STAR program, which began in 1997.

Only 25¢ for 5 months

ALBANY — The state’s changes in how some New Yorkers will receive their property tax rebates has created a bit of confusion for some taxpayers and local assessors who are fielding complaints about late checks.

For most families, the new tax break of about $130 for the New York City suburbs, including on Long Island, and $185 upstate is deducted upfront from local school property tax bills under the new version — included in the 2014-2015 state budget. Individual tax exemptions, however, can vary widely by community based on taxes and property values. The tax break is a new version of the popular STAR program, which began in 1997.

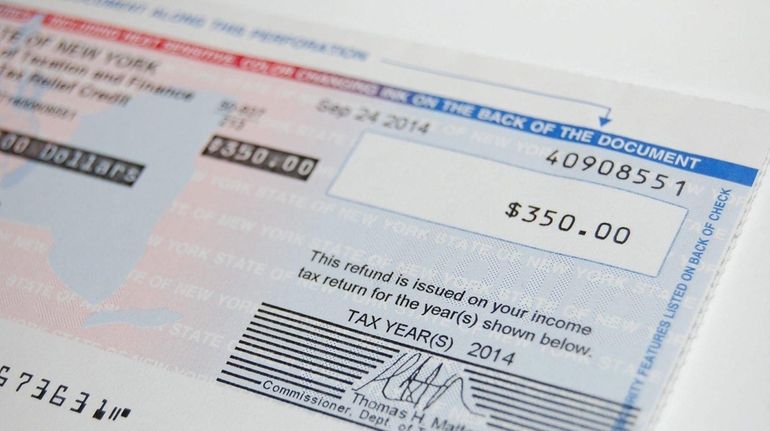

But for those who bought their homes after Aug. 1, 2015, the tax break was to be sent in a rebate check from the state Taxation and Finance department beginning in September.

The checks were issued and mailed beginning in September on a “rolling basis” and aren’t late, according to James Gazzale, spokesman for the state Department of Taxation and Finance.

Property taxpayers who haven’t yet received their credit check should expect it by Dec. 31, Gazzale said.

The state has a hotline at 518-457-2036 to call if taxpayers don’t receive their check by Dec. 31, he said.

The debate over the form of the benefit has been in part over which political entity could get more goodwill for reducing what remain some of the highest property taxes in the nation. Tax breaks paid upfront and reflected in tax bills come from local governments, while tax rebate checks come from Albany and are cut during the fall election campaigns.

The legislature and Gov. Andrew M. Cuomo included the change in the state budget as a way to combat fraud and duplicate checks to taxpayers with more than one home.

The governor and legislature also enacted a smaller “tax freeze” benefit to pay for increases in property taxes this year in municipalities that stay within the state’s 2-percent cap on property tax growth. In addition, families with at least one school-age child received a $350 family tax credit this year.

Local officials are finding the state’s changes to be taxing.The state told local tax assessors and collectors that checks would be sent in September, then changed that to October, then provided no update, said Nancy Schnurbusch, the Chenango town tax collector in Broome County and president of the New York State Association of Tax Receivers and Collectors.

“We have no control because the governor has taken that out of our hands,” she said Monday. “It’s unfortunate, but we have little control over it when the governor passes a budget that has so many add-ons.”

Details on the charges in body-parts case ... Gilgo-related search continues ... Airport travel record ... Upgrading Penn Station area