4 social media money trends worth knowing about

Be wary of money-saving tips offered on social media. Credit: Getty Images

Earlier this month, users of TikTok and X learned about a viral “hack” that encouraged bank customers to deposit checks they wrote for amounts greater than their bank balances and then withdraw the money before the check bounced. The only problem? That “hack” was actually a form of check fraud.

The incident highlights both the prevalence of social media money trends and the uneven reliability of financial advice shared on social platforms.

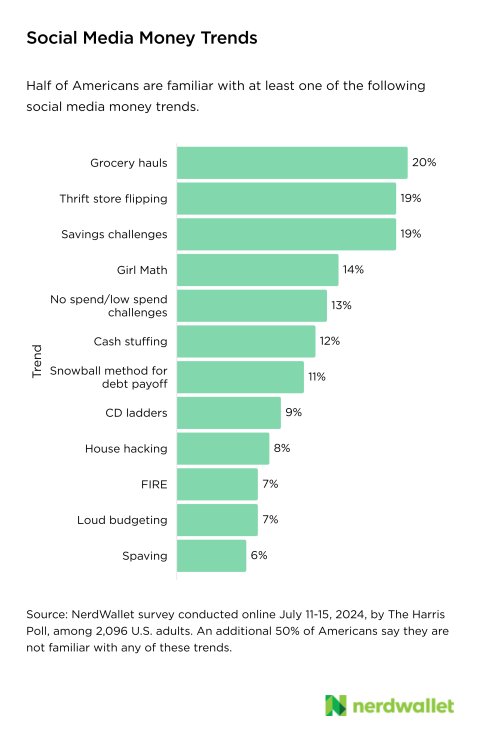

Half of Americans (50%) have heard of at least one social media money concept, according to a NerdWallet survey conducted online by The Harris Poll in July.

Some of these trends are new. But others are time-tested approaches to budgeting, investing or saving, rebranded with new names.

Here, we’re tackling four of the latter set, laying out what you need to know about these trends, how they could benefit you and some potential downsides.

No spend/low spend challenges

Thirteen percent of Americans say they’ve heard of no spend or low spend challenges.

Most recently, the no spend challenge went viral at the start of the year with the No Spend January TikTok trend. It challenged people to abstain from spending on any non-essentials (think things like eating out or buying new clothes) for the first month of the year.

The idea is you use the money saved to accomplish longer-term financial goals like paying down debt or saving for retirement. You keep track of each consecutive day in which you successfully spend nothing on non-essential items or services.

The goal of no spend challenges is to gamify disciplined spending in the hope that, as people see the amount of money they can dedicate to meeting their financial goals, they’ll be more mindful about what they spend their money on once the challenge is over.

Cash stuffing

Twelve percent of Americans say they’re familiar with cash stuffing.

Cash stuffing is a new spin on the classic “envelope system” of budgeting. For this budgeting hack, you draw up a budget — say for the following week or month — with expected spending categories like housing, groceries, transportation and discretionary spending. You assign each category to an envelope labeled as such, withdraw the funds in cash, and then place the budgeted amount in its envelope. You then spend down the cash in that envelope, and no more. Spend $50 that week at the grocery store? Then you take $50 out of the “groceries” envelope.

The goal is to help you visualize how much money you have to spend on any given category — and assess whether you’re actually staying within your budget.

Snowball method for debt payoff

About one in 10 (11%) Americans say they’ve heard of the snowball method for paying off debt.

This approach to paying off debt is based on balances, not interest rates.

To get started, list your debts in order from the smallest balance to the largest, alongside each debt’s minimum payment requirement. Then, decide how much additional money you can afford to put toward debt each month and dedicate that entire amount to paying off that smallest debt as quickly as possible. Once you’ve paid that first debt off, move on to the next smallest debt, and so on.

The idea is to build early momentum on your debt-repayment journey by knocking out the easiest-to-repay debts first.

One thing to keep in mind with this method is that it doesn’t take interest rates into account.

CD ladders

Nearly a tenth (9%) of Americans say they know about CD ladders.

Investing in certificates of deposit (CDs) can be a sound savings strategy as they offer a guaranteed rate of return that’s usually higher than a high-yield savings account while also being federally-insured like a bank account. The catch is you can’t access your funds until the deposit matures without paying a penalty (typical CD terms include six months, one year and five years). You trade a higher return for less flexibility. And generally (though not at the moment), the higher the rate, the longer the CD’s term.

The CD ladder approach allows you to get the best of both worlds by combining access to longer-term CDs’ typically higher rates with shorter-term CDs’ quicker access to invested money.

Power bills may increase ... What's up on LI ... Plays of the week ... Get the latest news and more great videos at NewsdayTV

Power bills may increase ... What's up on LI ... Plays of the week ... Get the latest news and more great videos at NewsdayTV