Offshore wind lease bids for six areas off NY, NJ coasts total $4.37B

Deepwater Wind offshore wind farm at Block Island in August 2016. Credit: Newsday/Mark Harrington

As the auction price for the next round of wind farm areas off the coast of New York/Long Island and New Jersey soared to more than $1 billion, the costs of projects for Long Island are coming into focus.

Six wind-energy areas went on the federal auction block on Wednesday, and prices quickly jumped ahead of the prior record for an area off Long Island of about $42 million in 2016 to more than $1.04 billion for just one large area off the New Jersey coast. Five other areas saw bidding reach from $285 million to $795 million.

In all, the Department of the Interior said, bids totaled $4.37 billion, and the top bid went to Bight Wind Holdings. PSEG Generation and Equinor weren’t among the winning bidders.

While it's still unclear how the record prices for the leases and recent cost increases for raw materials for wind farms will impact future energy prices, some of the costs for Long Islanders are becoming clearer. For LIPA, for example, the cost to purchase special state credits to help cover the costs of offshore-wind farm development over the next 25 years has been estimated to hit $3.5 billion, according to a utility estimate shown to Newsday.

New York state later this year is expected to issue the latest of several rounds of requests for proposals for offshore wind energy, and bidders could include developers from the federal auction in the wind-energy area known as the New York Bight. Most of the areas are nearer to New Jersey than New York.

Under a system established by the New York State Energy Research and Development Authority, LIPA and all other state utilities will be expected to buy a portion of new credits called Offshore Renewable Energy Credits to help cover development costs over and above the cost of energy from the arrays. LIPA’s obligation is expected to be just over 12% of the credits from NYSERDA, although it won’t need to buy them for its South Shore Wind Farm project because it contracted for that project directly.

LIPA chief Tom Falcone, in an interview with Newsday, said that because NYSERDA is buying power on a large scale, it's generally more economical for LIPA to buy offshore wind-energy through the state agency, though LIPA is still free to contract for its own projects. Wind farms for the state cost roughly $3 billion to produce. LIPA’s contract for the South Fork Wind Farm is for $2.013 billion over 25 years.

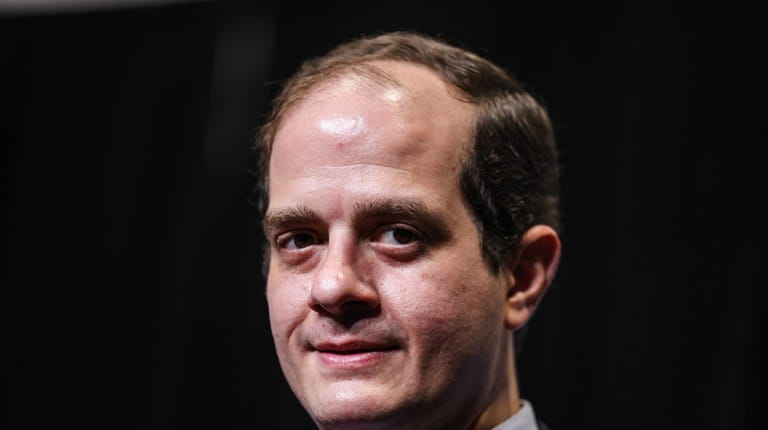

Thomas Falcone, CEO of LIPA, during a groundbreaking for the future South Fork Wind Farm in Wainscott, Friday, Feb. 11, 2022. Credit: Newsday/Steve Pfost

NYSERDA has awarded more than 4,300 megawatts of offshore wind projects for the state, and plans at least another 4,700 megawatts by 2035. Falcone said the total could reach double that figure as the state, and Long Island, become more electrified to feed growing fleets of electric cars and heat pumps.

LIPA's $3.5 billion estimated share of the state credits would amount to around $140 million a year in new costs for LIPA customers over the 25-year life of the projects. That’s atop the $2.013 billion ratepayers will pay for the 130-megawatt South Fork Wind Farm, LIPA’s third most expensive active contract, according to a state database.

Falcone declined to confirm or deny the $3.5 billion figure but said there are so many variables related to offshore wind and LIPA’s expectations for the future grid that it’s hard to pin down any cost specifically.

The cost is nothing to sniff at — each roughly $36 million of cost represents about a 1% rate hike — but that doesn’t take into account savings LIPA and the state could see as cheaper offshore wind power hits the grid and potentially moderates other wholesale energy costs, Falcone said.

The estimated $3.5 billion is also lower than LIPA’s largest contract for $5 billion to contract for power from National Grid’s fleet of power plants across the Island — a contract that expires in 2028. LIPA is expected to retire plants in coming years and decades, and sharply lower that contract cost.

The estimated $3.5 billion cost, divided over 25 years, would make up a relatively small part in LIPA’s overall annual budget of $3.7 billion. But the figure doesn’t take into account additional costs associated with offshore wind, including grid enhancements. LIPA is locked in a dispute with the state Public Service Commission about how much of those enhancements it should pay for.

Falcone said LIPA expects to move away from a summer-peaking utility, where most power is produced chiefly for summer air conditioner use, to one that more evenly delivers power during the year. If heat pumps take off as the state plans, LIPA and other utilities could even see greater use in the winter, as fossil fuel heating is phased out. Steadier use of power year-round could lead to greater grid efficiencies to help moderate costs, he said.

It's not just offshore wind renewable credits LIPA must buy. According to the state comptroller’s database, LIPA also will pay $820 million between 2019 and 2029 for zero emission credits to help the state subsidize the continued operation of upstate nuclear power plants. LIPA owns an 18% interest in one of those plants, Nine Mile Point II, and receives some credits back for that ownership. Accounting for those credits, LIPA said it expects to pay the state $559.4 million through 2028.

LIPA also must pay $700 million from 2021 through 2050 for so-called "tier 1" renewable energy credits, to pay for other state renewable projects, including solar farms that will feed the grid. LIPA said it hasn’t begun making the payments yet and will only do so once these projects, such as state-contracted solar farms, begin producing energy.

The estimated $700 million cost equates to $35.34 million a year, LIPA said, but noted that the contract with NYSERDA is "flexible and allows LIPA to choose the quantity of … (credits) it wants to buy in any given year, within the limits stipulated in the contract."

Gilgo Beach search latest ... Tax breaks for manufacturer... Knicks playoffs ... Islanders vs. 'Canes, Game 3

Gilgo Beach search latest ... Tax breaks for manufacturer... Knicks playoffs ... Islanders vs. 'Canes, Game 3