Laura Curran: Nassau deficit expected to hit $749 million over 18 months

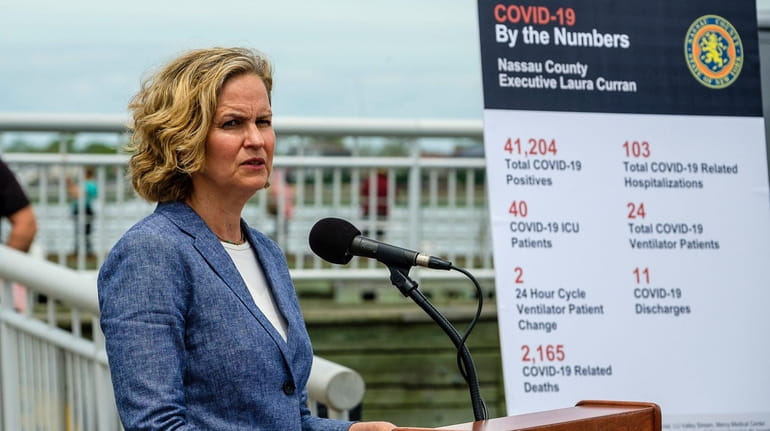

Nassau County Executive Laura Curran speaks during a briefing on June 15. Credit: Jeff Bachner

Nassau County faces a $749 million budget deficit over the next 18 months due to the economic damage from the coronavirus pandemic, according to a midyear report expected to be released Wednesday.

County Executive Laura Curran said she plans to help close the budget gap by asking the Nassau Interim Finance Authority, the county's financial control board, to refinance $285 million over the next two fiscal years.

The Office of Management and Budget report, due Wednesday, shows the county running a $385 million budget shortfall in fiscal year 2020 and an additional $364 million deficit in 2021.

The primary cause is a steep expected drop in sales tax revenues, which account for 40% of all county revenue.

“Whatever the crisis may be, my administration will always meet the challenge of protecting our residents, but we will need a balanced budget to do so,” Curran said in a statement Tuesday night.

"This is an unprecedented event," Curran said of the pandemic. "We are not alone in dealing with this — the state and Suffolk are dealing with it. The drop in economic activity was like falling off of a cliff in terms of the magnitude of this problem."

Curran, a Democrat, said "the alternative of not using the NIFA tool is [a] drastic cut to county services."

The administration plans to attack the 2020 deficit of $385 million through refinancing of $75 million of NIFA and county debt; $112 million in personnel cost reductions from a 2019 surplus that included strong sales tax revenue and reductions in personnel; and $103 in federal CARES Act funding for pandemic expenses. The remaining $95 million gap isn't accounted for in the report.

For 2021, Curran is hoping to rely on $210 million from refinancing of NIFA and county debt; $70 million in savings from reduced future hiring; $50 million in reduced program spending, $25 million in agency savings and $9 million in other expense reductions, the report and budget officials said Tuesday.

"These series of expense reductions are under development and would significantly impact the delivery of the County’s services, and this reduction in services would be felt by all residents, businesses and taxpayers," the report says.

The State Legislature in April increased NIFA’s bonding authority. Last week, NIFA board members selected the financial firm Goldman Sachs to restructure any debt the county may request.

NIFA, created in June 2000 as a public benefit corporation, oversees the county’s finances and has the ability to bond on behalf of the county, which typically has to pay higher interest rates.

Curran's refinancing plan will require the approval of the Nassau County Legislature, where Republicans hold an 11-8 majority.

Legislative Presiding Officer Legis. Richard Nicolello (R-New Hyde Park) said Tuesday night the GOP caucus majority would “carefully review” Curran’s proposal.

But Republicans historically have been cautious about borrowing through NIFA as the county’s finances would be under their review for the life of the debt.

“We are extremely hesitant to allow NIFA to borrow any money on behalf of the county because it will extend the existence of the unelected control board to 2051,” Nicolello said.