Application for disaster loans exposed business owners' personal data

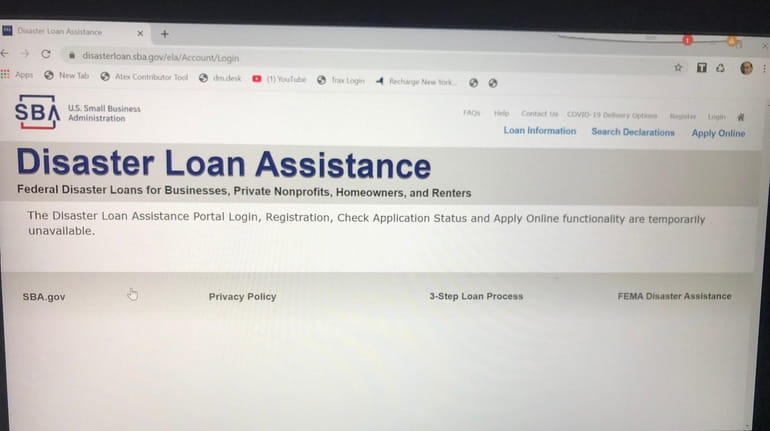

SBA disabled the portal's online application function on Wednesday, and applicants for disaster-relief loans are being asked to use alternate means to get their information to the agency. Credit: Newsday File/James T. Madore

About 100 business owners had personal information exposed when they used a government online portal that was unsecured to apply for federal disaster loans, officials said Friday.

The information, including names, addresses, birth dates and Social Security numbers, was exposed to other users of the online application portal, according to the U.S. Small Business Administration, which runs the disaster loan program.

The agency hasn’t yet provided geographic information for the business owners who had their personal information exposed. However, they are being notified individually and offered free credit monitoring for one year.

SBA disabled the portal’s online application function on Wednesday. It was unclear on Friday how long the personal information was exposed.

Applicants are being directed to download PDFs of the application forms at disasterloan.sba.gov/apply-for-disaster-loan/index.html and upon completion upload them to the SBA via the BOX widget on the website. Completed applications also may be emailed to disasterloans@sba,gov, faxed to 202-481-1505 or sent via postal mail to the U.S. Small Business Administration Processing and Disbursement Center, 14925 Kingsport Rd., Fort Worth, Texas, 76155.

“Personal identifiable information of approximately 100 Economic Injury Disaster Loan applicants was potentially exposed to other applicants on the SBA’s loan application site,” agency spokeswoman Jennifer F. Kelly said Friday from Washington. “We immediately disabled the impacted portion of the website."

The agency said Thursday it has seen “a surge of applications from Long Island.”

The disaster loans are for up to $2 million per applicant and can be repaid over a maximum of 30 years. The interest rate is 3.75%.

To be eligible, a business must have 500 or fewer employees and be unable to secure other financing to keep operating.

More information is available by calling 800-659-2955. The deadline to apply is Dec. 21.

Downtown businesses' needs

Separately, one third of small businesses in local downtowns won’t reopen without a government loan or grant, according to a survey of 275 business owners conducted in the past two weeks by the LI Main Street Alliance, which represents downtowns undergoing revitalization.

In the poll of restaurants and stores in 40 local downtowns, more than 50% said they are temporarily closed because of the government-ordered shutdown of non-essential businesses and 30% are only offering takeout and delivery services. Among the businesses that are operating, sales are down 80% to 90%.

“Independent small businesses in downtowns are experiencing severe economic pain,” said alliance founder Eric Alexander. “How long that pain lasts will depend on community support for these businesses, when loans and grants reach them and the duration of the shutdown.”